True On-Chain Trading

Trade any token on Base directly from your wallet. Enjoy transparent pricing, fast confirmations, and complete control of your assets.

100% Transparency

All trades and rewards visible on-chain.

Self-custody

No deposits or third-party custody.

Instant settlement

No delays, no off-chain risks.

Base-powered

Optimized for scalability and low fees.

Engineered for Traders.

Designed for Transparency.

Zero-Fee Perpetuals — Trade Profitably, Pay Only When You Win

Trade without upfront costs — fees apply only to profitable positions. Maximize margin efficiency and keep every dollar working for you.

Risk-Tranche Liquidity Pools — Earn Yield on Your Terms

Choose senior (safer) or junior (high-return) pools. Control your exposure, earn real yield, and shape your risk/reward profile.

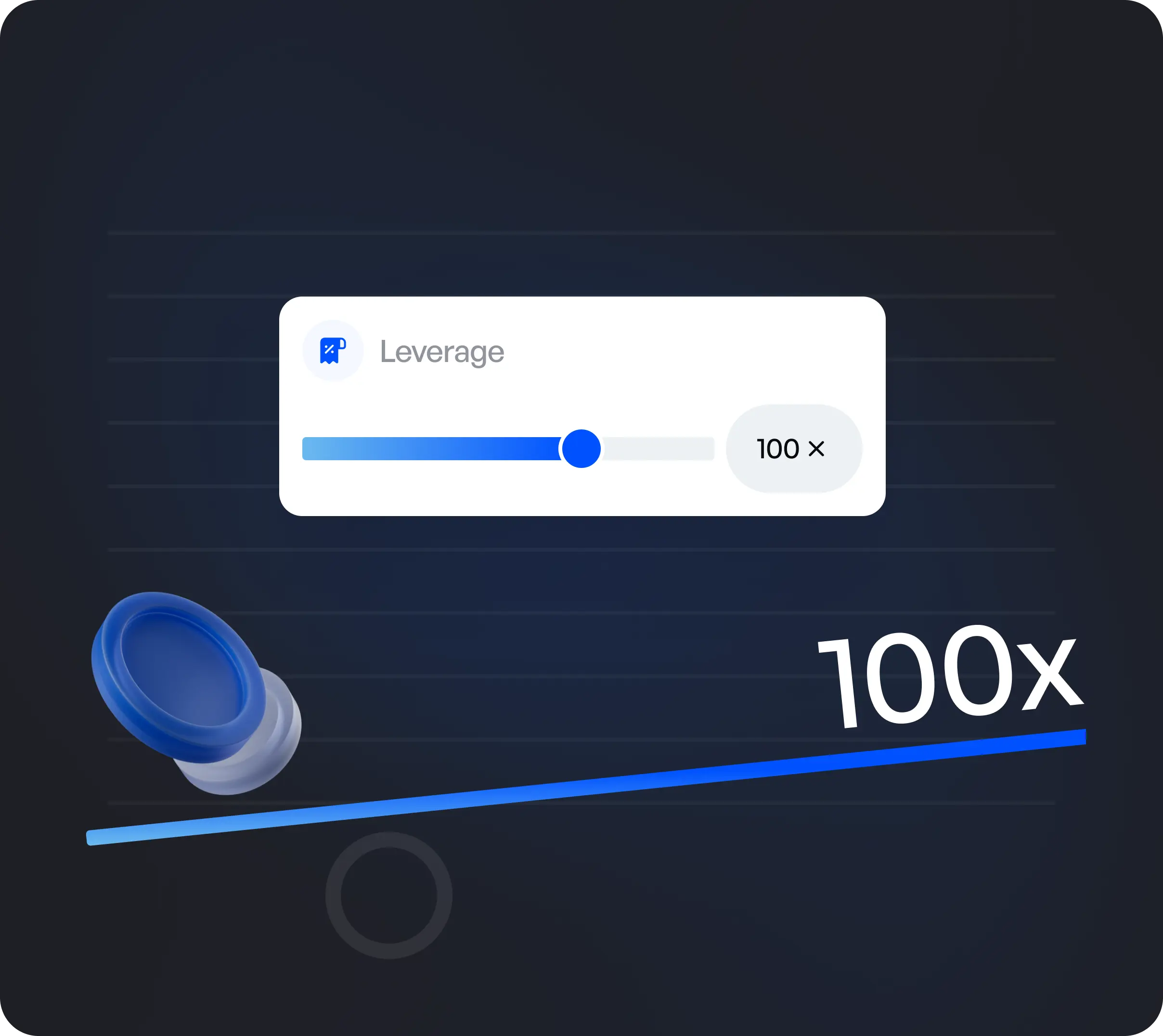

High Leverage, On-Chain Security — Power Meets Protection

Access top crypto and synthetic markets with Base-level speed and built-in liquidation guards ensuring on-chain safety.

Perps are the purest form of crypto. No custody, programmable liquidity — that’s where the money flows. This market still has a 50x runway.

Arthur Hayes

Co-founder, BitMEX

50x

Potential

Intuitive design. Powerful experience.

Experience a clean, human-centered design that makes complex blockchain interactions feel natural.

Trusted by leading crypto media

BasePerp Becomes the First Base-Native Perpetual DEX

Perpetual DEXs are catalyzing ecosystem growth and DeFi expansion, attracting traders, liquidity...

BasePerp: The First Native Perpetual DEX Powering Liquidity on Base

BasePerp launches as the first native perpetual DEX on Base, bringing high-performance derivatives trading, deep liquidity, and new TVL growth to the ecosystem.

How BasePerp Turns Base into a Perpetual Futures Liquidity Hub

Discover how BasePerp leverages Base’s scalability to offer native perpetual futures, attract institutional and retail traders, and strengthen DeFi liquidity on-chain.

BasePerp Launch: Native Perpetual DEX Driving TVL and Institutional Flow on Base

The article explains why perpetual DEXs dominate 2025 and how BasePerp aims to become the core derivatives hub on Base, driving TVL, volume, and user migration.

BasePerp to Enable Creation of Perpetual Futures Markets on Base (3 Nov)

The perpetual futures market now represents a dominant liquidity driver in crypto. Platforms across the sector have proved that perpetual derivatives can outpace spot market growth,

BasePerp to Enable Creation of Perpetual Futures Markets on Base (3 Nov)

BasePerp has announced the launch of the first native perpetual decentralized exchange (DEX) built on the Base blockchain.

Perp DEXs: Top perpetual DEXs by open interest and trade volume

The year 2025 has become a year of massive inflow into DeFi and a new wave of interest in decentralized finance. With over 50% growth by the year, the global cryptocurrency market cap reached $3.85 trillion.

Perp DEXs: Top perpetual DEXs by open interest and trade volume

The year 2025 has become a year of massive inflow into DeFi and a new wave of interest in decentralized finance. With over 50% growth by the year, the global cryptocurrency market cap reached $3.85 trillion.

Integrate in a few lines of code

Tokenomics Overview

Public Token Sale

1,600,000,000

25%

Liquidity Provision

960,000,000

15%

Core Team

1,024,000,000

16%

Growth Programs

768,000,000

12%

Ecosystem Growth

768,000,000

12%

Community Incentives

768,000,000

12%

Operations Reserve

384,000,000

6%

Airdrop & Bug Bounties

128,000,000

2%

Roadmap Overview

- Start of active protocol and platform interface development.

- Launch of the $BPERP Presale to fund the next stages of growth.

- Building and expanding the community of traders and early supporters.

- Preparing for initial testing and external security audits.

UTILITY

$BPERP — The Core of the Ecosystem

The $BPERP token connects traders, liquidity providers, and early supporters through shared incentives, real yield, and long-term participation benefits.

Trading Rebates

Earn $BPERP rewards through the loss-rebate system.

Contrarian traders receive extra compensation on losing trades.

Active traders unlock higher rebate tiers.

Liquidity Mining

Stake LP tokens or $BPERP to earn real on-chain yield.

Rewards come from trader profits and protocol fees.

Choose senior or junior pools to balance risk and return.

Fee Discounts

Hold or stake $BPERP to reduce performance fees.

Unlock premium tiers and early access to new markets.

Gain execution priority during high-volume trading.

Insurance Pool

$BPERP supports the insurance reserve protecting users.

Stakers earn a share of protection yield.

Strengthens protocol stability and user confidence.

Frequently asked questions

What is BasePerp and who is it designed for?

BasePerp is a Base-native perpetuals DEX built for active traders, quants, arbitrageurs, market makers, and liquidity providers who want fast, on-chain execution and transparent risk controls.

What are the key advantages?

Zero-fee entries/exits with pay-on-profit pricing; lightning-fast execution on Base; transparent risk management (Execution Guard, deviationGuard, portfolio-safe liquidations); MEV/front-run resistance; risk-tranche liquidity for tailored yield.

What does the zero-fee model mean?

No maker/taker fees on opens or closes. You only pay network gas, normal market costs (spread/slippage), funding, and a fee only when a trade closes in profit.

When is the win-based fee charged?

On realized positive PnL at close or partial close (including triggered TP). The fee equals profit Fee Rate × realized profit. No charge on losing or break-even trades.

Who audited the smart contracts, and where can I view the reports?

An independent security audit is underway. We’ll publish full reports and artifacts once finalized.

Money Moves newsletter

Email address